Insurance is important because it protects individuals and businesses from financial losses due to unexpected events, such as natural disasters, accidents, theft, or illness. By paying premiums, you transfer the risk of financial loss to the insurance company, which agrees to pay for damages or losses incurred under specified conditions. This helps to provide financial stability and security, enabling policyholders to plan for the future with more confidence.

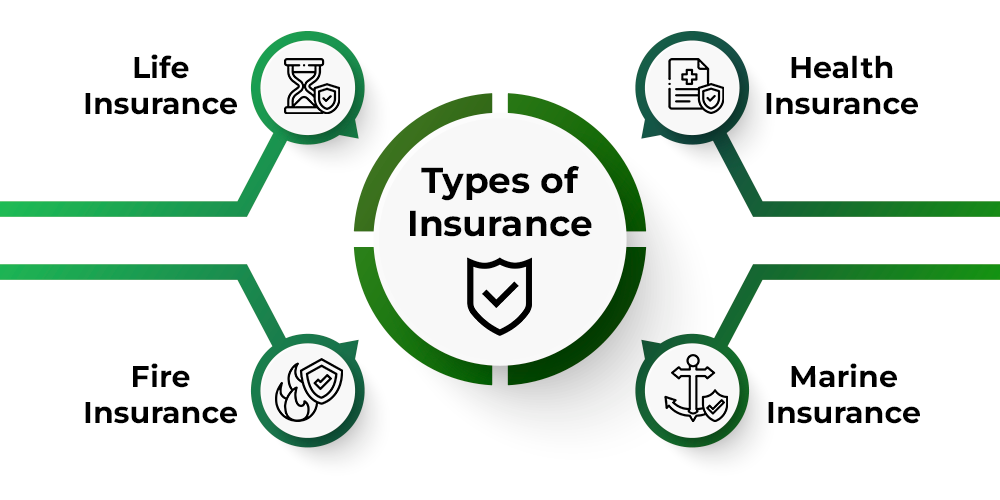

Types Of Insurance and their Coverage

Life Insurance

Life insurance is a type of insurance that pays a lump sum to the named beneficiaries upon the death of the insured person.

The purpose of life insurance is to provide financial protection and security to the policy holder’s loved ones in the event of their death. This can help to cover expenses such as funeral costs, mortgage payments, and living expenses, ensuring that the policyholder’s family is not left with financial burden.

There are two main types of life insurance: Term life insurance and whole life insurance, which offer different levels of coverage and premiums. It’s important to choose a life insurance policy that meets your specific needs and budget.

Accident Insurance

Accident insurance is a type of insurance that provides financial protection in the event of an accidental injury. It typically pays out a lump sum benefit to the policyholder or their beneficiaries if they suffer a covered injury, such as a broken bone, loss of limb, or death. This can help to cover medical expenses and lost income as a result of the accident.

Accident insurance is often sold as a standalone policy or as an add-on to a life insurance or health insurance policy. The amount of coverage and the premium will depend on factors such as the policyholder’s age, health status, and the type of policy purchased. Accident insurance can provide valuable financial protection and peace of mind in the event of an unexpected accident.

Medical Insurance

Medical insurance, also known as health insurance, is a type of insurance that covers the cost of medical expenses incurred by the policyholder. It helps to pay for services such as doctor visits, hospital stays, surgeries, prescription drugs, and other medical needs.

The goal of medical insurance is to provide financial protection against the high cost of healthcare and to help ensure that individuals have access to necessary medical care when they need it.

There are various types of medical insurance, including employer-sponsored plans, individual plans, and government-sponsored plans. The type of plan, the amount of coverage, and the premium will depend on factors such as the policyholder’s age, health status, location, and the type of policy purchased. Medical insurance can provide peace of mind and financial stability for policyholders and their families.

What kind of insurance is important for family any why?

The type of insurance that is most important for a family depends on their individual needs and circumstances. However, some commonly recommended types of insurance for families include:

Health insurance: To cover the cost of medical expenses for the entire family.

Life insurance: To provide financial protection for surviving family members in the event of the death of a breadwinner.

Homeowner’s insurance: To cover the cost of repairs or rebuilding in the event of damage to the family home.

Auto insurance: To cover the cost of repairs or replacement in the event of an accident.

Disability insurance: To provide financial support in the event of a breadwinner’s inability to work due to a disability.

Insurance is important for families because it helps to provide financial protection and stability in the event of unexpected events. By transferring the risk of financial loss to the insurance company, families can feel more secure and confident in their financial future.

Additionally, insurance can help families to plan for the future by covering expenses such as medical bills, mortgage payments, and other living expenses.

Important things to remember before get any insurance

Before getting any insurance, it’s important to keep the following things in mind:

Determine your coverage needs: Consider what risks you need to protect against and what type of coverage you need.

Shop around for the best policy: Compare different policies and insurance companies to find the one that best meets your needs and budget.

Read the policy carefully: Make sure you understand the terms and conditions of the policy, including what is covered and what is not.

Consider the cost of premiums: Compare the cost of premiums and make sure you can afford the payments.

Check the financial stability of the insurance company: Make sure the insurance company is financially stable and has a good reputation.

Consider the policy’s exclusions: Be aware of any exclusions or limitations in the policy, such as pre-existing conditions.

Review the policy regularly: Review your policy regularly to make sure it still meets your needs and to ensure that you are getting the best coverage for your money.

Ask questions: If you have any questions or concerns about your policy, don’t hesitate to ask your insurance agent or representative for clarification.

By keeping these important things in mind, you can make an informed decision about the insurance coverage that is right for you and your family.

Conclusion

In conclusion, insurance plays a crucial role in protecting individuals and families from financial losses due to unexpected events. Different types of insurance, such as health insurance, life insurance, homeowner’s insurance, auto insurance, and disability insurance, can provide financial protection and security in a variety of different circumstances.

When choosing an insurance policy, it’s important to determine your coverage needs, shop around for the best policy, read the policy carefully, consider the cost of premiums, and ask questions. By making an informed decision about insurance, you can ensure that you and your family are protected against financial losses and can plan for the future with confidence.

Note – This Blog is just for information, Before doing any financial activities. Please ask to you financial advisor, Must understand Investment Policies, Return, time and every related to Company.